An incomplete overview of consumer payments in Nigeria

There are multiple challenges, but the payments space could become one of the best things about Nigeria

Introduction

As far as I can tell, my parents are more tech-savvy than a lot of their peers - and yet some things still slip through the cracks. The other day my father needed to travel by bus to a city ~4 hours away, and to do this he (i) went to an ATM, (ii) got out cash, (iii) went to the bus station, booked and paid for tickets, then went home. The first 2 steps are separate because he had to queue for a really long time - which is unusual but was happening that day because of some unrest in the country.

So - my parents typically book and pay for airplane tickets online, no problem. But for some reason it didn’t occur to either of them that they could do the same thing with bus tickets, and also - having had years of experience with POS failures at critical points, they tend to think that cash is a handy backup to have at all times. That’s not the way I think though, and maybe the point here is that there’s a generational divide in fintech literacy levels, i.e. knowledge of - and exposure to - convenient payment options. I almost never think about needing cash to pay for something in an establishment because I know about a number of other options, and a lot of the people around me are the same way.

Apart from the generational divide, there’s a socioeconomic one. People in low income households and people who are unbanked share some of the same dependencies on cash as the primary means of payment.

People who are banked and in urban areas have a lot more access to advanced financial services than people in rural areas. As with many other developing economies, there’s an opportunity to deliver some level of digital financial services (DFS) advancement to the unbanked by taking advantage of technology. It hasn’t quite clicked yet, though.

Let’s begin with some wins (for the banked population)

Wins

Amplify exit

Amplify is a payment solutions provider specifically for subscription businesses, and it was recently acquired by OneFi, a consumer finance company (more on them later). This is a win because with Nigerian startups, we don’t see that many exits.

Paystack exit

My favorite payment service provider was acquired by Stripe for $200m recently, and everyone’s looking forward to seeing how things progress.

NIBSS

Thanks to the Nigerian Inter-Bank Settlement System (NIBSS), real time retail payments are a thing, which means that bank transfers are really quick for the most part. If I send you some money, you’ll get it in <2 minutes, all things being equal. This is how it should be and under normal circumstances I wouldn’t mention it but I’ve learned that in places like North America, instant bank transfers are not really a thing; the Interac system in Canada seems okay but even that is by no means instant.

Transaction types

Most online transactions are peer-to-peer (P2P) transfers. P2P includes sending money to a friend, or transferring money to a business owner for goods purchases/services rendered. More statistics here.

Context-specific solutions

BVN

The Bank Verification Number (BVN) is an 11-digit code that’s used to identify you across all your Nigerian (personal and business) bank accounts. Think of it as a social security number, although it’s not entirely the same thing.

The main reason it exists is to combat fraud in the banking system and most financial institutions use it to verify your identity, including consumer-facing fintech platforms. There are opportunities to use it in other ways, such as (i) making it more convenient to open a new bank account if you already have an existing one (don’t know that this is working out 100%, and it’s either because of stringent-but-really-inconvenient-for-the-customer regulation, or institutions being sluggish to adopt new processes), and (ii) there’s also the opportunity to use it to recover debts, which just started happening.

Tokens

Online shopping is still a relatively new phenomenon in Nigeria, although cashless payment is not. That, coupled with the fact that Nigeria is a low-trust society, means that most eCommerce payments usually include some form of 2FA. It adds friction, yes - but it’s also a form of reassurance for the customer.

USSD

When mobile phones began to proliferate in Nigeria in the early 2000s, the way to get talk and text units - also known as airtime, phone credit, or top-ups - was not by signing up to a monthly phone plan, it was by going physically to buy from a vendor. What you would buy was essentially a piece of paper or scratch card worth a certain amount which, when scratched, would reveal a code that looked like this: *123*4567890123#. You’d dial the code and then your phone would be loaded with whatever amount you were expecting. This was the way to do it for a very long time, until we got smartphones, digital banking, online payments, and all the associated things that come with technological advancement. But you can see how an entire population of people would have gotten very familiar with this system of *123*4#.

That said, about half of the population own mobile phones but only about a quarter own smartphones, and in any case, constant internet access is not affordable for a large segment of the population - but even when it’s available, it’s not always reliable. This means for example, that if you’re in a fairly remote area and attempt a digital transaction, you may be disappointed (happens in urban areas as well, maybe not as often - but often enough for my parents to still feel the need to have cash as a backup).

Enter USSD, which does not require internet access or a smartphone. As long as you have cell service and a bank account, you can use USSD wherever you are in Nigeria. The actual implementation varies by bank but in general, bank (peer-to-peer) transfers are really straightforward: *123*2*amount*recipient#, and there might be 1-2 extra steps for more complicated things like bill payments (e.g. “tap 1 to pay N5,000, tap 2 to pay N7,500”) or opening a bank account (yes, you can do that with USSD).

mCash: Uses the USSD system, but is more targeted at small businesses and low income customers. In the spirit of the cashless policy, this platform is supposed to provide a more convenient, cashless way to pay small businesses. Here’s how it works.

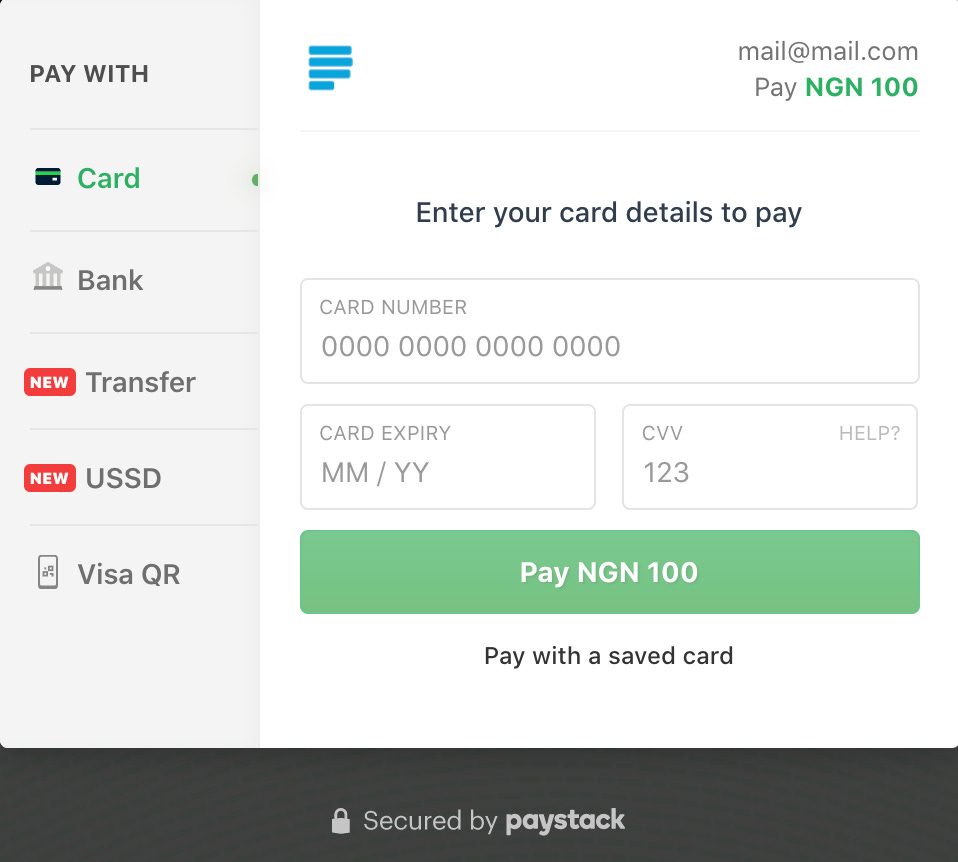

Online payments

When you visit an eCommerce site, the payment options might include credit cards (MasterCard, Visa, Amex, Maestro, others), Apple Pay, iDeal, Google Pay, PayPal, etc. In Nigeria, the payment options reflect what’s available in the market (it’s not possible to pay with PayPal, for example), as well as what customers feel comfortable with.

USSD

If you select this option,

you’ll be provided with a USSD code,

dial it with your phone, follow the prompts, then

tap a button on the retailer’s site to indicate you’ve made the payment.

Payment will be confirmed immediately, and then the transaction is complete.

Bank payment

You could login to your bank app (via an embedded web view on the retailer’s site) and pay that way

Transfer

With this option,

you’ll be provided with bank account details, then

make a P2P transfer some other way (outside of the retailer’s site), and then

tap a button on the retailer’s site to indicate you’ve made the payment.

Once that’s done, your payment will be confirmed immediately, and then that’s it.

Visa or MasterCard - and sometimes Verve, depending on the payment provider

This works the normal way, except that there’s always 2-or-3-factor authentication.

Visa QR code, if your bank has enabled that option

This is another way of paying outside the retailer’s site. You scan a QR code, complete the payment and come back to indicate that you’ve made that payment. There will then be a background process that runs to check that this payment has been received, and you will see some confirmation afterward (or an error message).

Sidebar

If you’d like to see and play with these options yourself, there are demos on Paystack and Flutterwave. Flutterwave only shows you options that are relevant to your location, so make sure the URL is https://flutterwave.com/ng/checkout.

Cryptocurrency

Nigeria’s official position on cryptocurrency is that crypto assets are securities. That said, this industry is still young and I do not know any retail merchants that accept cryptocurrency as payment, but there are platforms that allow you buy and sell cryptocurrency: BuyCoins, BitPesa, FirstKudi. There also seems to be at least 1 platform that allows you make certain transactions with Bitcoin: Patricia.

Trends

Current trend: Everyone becomes an aggregator

This is more related to the fintech industry in general than to payments alone, but I’ve seen a number of companies evolve from offering one type of service, to doing all the things.

Carbon (owned by OneFi) has moved from being a lending platform to also having bill payments, savings, and credit reporting;

Piggyvest used to just be a really good savings app, now they offer loans, investment opportunities, and more

Aella Credit used to be a lending app, but has expanded its repertoire to include investments, insurance, bill payment, etc.

Disappearing trend: Social payments

By ‘disappearing’ I mean that I don’t see anyone currently running with this model

OneFi was planning to add payment options to WhatsApp and other platforms, but I can see how that plan might be shelved for now given that WhatsApp itself is introducing in-app payments;

Kudi used to be a Facebook chatbot that you could use to make P2P transfers and utility bill payments, but the business model has since evolved to include other services.

Financial inclusion

Financial Inclusion (FI) means having access to and being able to afford basic financial services - insurance, lending, payments, savings, pension.

In the most recent version of the financial inclusion strategy, the Central Bank of Nigeria has expanded access to enable more institutions (in telecoms, postal services, etc) enter the mobile money space. These institutions already have a wide reach and brand recognition across the country (urban and rural areas), and this ‘expanded access’ is in the form of something called a Payment Service Bank (PSB) license which - among other things - allows them deploy mobile money agents across different locations in Nigeria. Mobile money is one of the ways developing nations drive financial inclusion.

That said, the regulatory requirements to become a PSB aren’t very cost effective, and the services PSBs can engage in are limited. They are only allowed to handle payments and savings, but those alone do not make for financial inclusion.

Opportunities

Regulation

Financial Inclusion: Technology alone cannot drive financial inclusion, and the opportunity here is to revise these regulatory requirements and expand the list of services PSBs can offer. Even just allowing PSBs offer micro-lending services could be a step in the right direction - and it’s worth noting that the CBN’s FI strategy doc acknowledges this opportunity, even if it’s not going to be acted upon right now.

Customer Experience: Like I mentioned under BVN, there are actually stringent-but-really-inconvenient-for-the-customer rules that help make things safe but that could probably be dealt with differently, given advances in technology.

Merchants

As part of the drive to achieve a cashless society, we’re trying to digitize retail payments. However research shows that merchants do not receive enough value from the current crop of digital payment solutions and so have little incentive to actively offer them to customers. Among other things, there’s an opportunity to digitize retail payments quicker, by including more value added services - such as customer relationship management, loans, etc - in the merchant side offerings.

Conclusion

Payment services in Nigeria continue to improve and provide customers with more options and better experiences, but there’s more work to be done.

Thank you for reading, have a great week!